4.3 million APH shares of An Phat Holdings (APH) will be offered to the public through auction on HOSE on June 22nd 2020. With the starting price of VND 25,000 VND per share, is APH appealing to the investment cash flows?

Small IPO, APH gives priority to long-term funds

Mr. Pham Do Huy Cuong, Standing Deputy General Director and Chief financial officer of An Phat Holdings (APH) disclosed that, according to the original plan, APH wanted to issue a maximum of 20 million shares in the IPO in order to have strong financial resources for the construction of their compostable material manufacturing plant.

Following by, the total capital needed for the project is over USD70 million, the Corporation plans to call for 50% capital from owners’ equity and 50% from borrowed capital.

However, after working with investment funds, APH decided to give priority to issue most of its shares in IPO to long-term investment funds. Therefore, 4.3 million shares were offered to the public in the IPO.

The Initial Public Offering will help APH determine the market price as a basis for negotiating and closing the selling price with some investment funds that have worked with APH for months. If the issuance is successful, APH will have 3.2% ownership of the new public investors.

The majority of ownership in APH will be held by major shareholders and long-term shareholders. With a shareholder structure that is not too scattered, the stock value will be reflected better by the Corporate’s business performance and outlook.

In the current shareholder structure of APH, there is IGG USA Vietnam Co., Ltd., currently owns over 40% of capital. It is known that IGG is a purely financial investment institution, but it has a long-term ownership commitment with APH. The role of this organization is to assist APH to boost exports to the North American market.

Aside from the above major shareholder, APH also has KB Securities Company, which owns 9.91% of the capital by investment trust of Value System Fund (Korea).

Answering the question of Tinnhanhchungkhoan.vn on whether after this IPO, APH continues to be bought by foreign institutional investors which lead to the ownership picture in APH will be in favour of foreign investors, MR Cuong said that, the Board of Management, internal stakeholders and strategic shareholders (IGG) had pledged to hold 51% of the capital in APH. Therefore, even foreign investors places large orders, in fact, their ownership will not exceed 50%.

Why APH’s starting price is VND 25,000 per share?

For public shareholders, their concern is why APH chose the starting price of VND 25,000 per share. Is this price attractive compared to other companies in the same industry?

APH leaders then shared that at the end of 2017, when Korean shareholders joined APH, they invested at the price of VND 25,000 VND per share. In the past 2 years, APH has increased the scale of revenue and profit by 4-5 times compared to 2017, so the company’s valuation is much better.

However, the IPO still chooses 25,000 VND as the starting price, while the actual selling price will depend on the demand of investors.

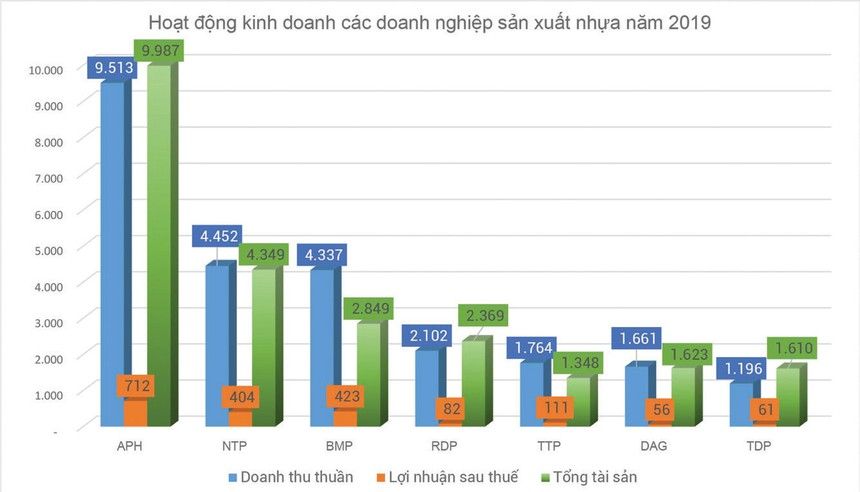

In the field of plastic manufacturing in Vietnam, by the end of 2019, APH leads the industry in both sizes, revenue and profit, surpassing big names such as Tien Phong Plastic JSC (NTP), Binh Minh Plastic JSC (BMP), Rang Dong Holdings JSC (RDP)… (Table 1).

In detail, APH’s total assets in 2019 reached VND 9,987 billion, 2.2 times higher than the second-largest enterprise is NTP. APH’s net revenue in 2019 also reached VND 9,513 billion, profit after tax was VND 712 billion, far exceeding that of peers in the same industry.

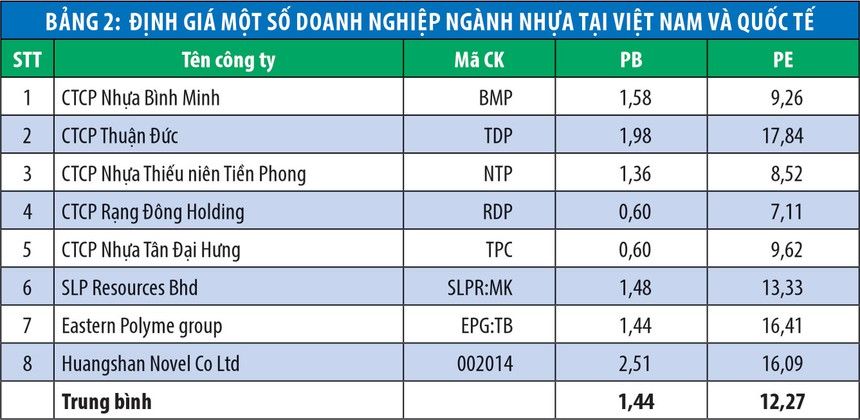

Considering the core business of plastic bags and engineering plastics, there is currently no listed company in Vietnam that has production scale and revenue as APH. In Asia, some companies of the same size as APH such as SLP Resources (Malaysia), Eastern Polymer (Thailand), and Huangshan Novel (China) have much higher P/E ratio and P/B valuations than P/E (12.2x), P/B (1.4x) of APH. At the price of VND 25,000 per share, APH’s P/E ratio is only 7.3 in 2019 (Table 2).

With the growth rate of 16-18% in the past 5 years, the plastic industry is currently only behind the telecommunication industry, textiles and garment industry while it is a thriving industry that witnessing more and more businesses are entering the market.

Though the competition is getting tough, APH stated that it will pursue the strategy of becoming the largest bioplastics group in Southeast Asia with the orientation of both organic and M&A direction.

APH’s determination to build compostable material manufacturing plant, according to Mr. Cuong, will help APH have the raw material self-supply, increase the company’s value, and create competitive moat compared to other packaging manufacturers and raw material manufacturers.

This is the Group’s organic development. Along with that, APH is determined to cooperate with large financial corporations, expanding production and business through investment in increasing capacity of potential business segment and expanding M&A activities.

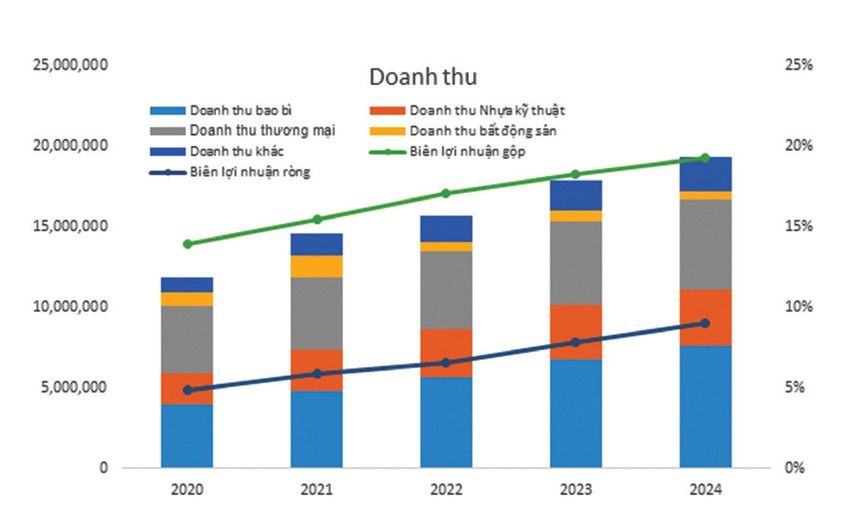

APH expects revenue growth of 24% in 2020 while CAGR at 15% in the next five years. In the company’s financial picture, AAA is still the main contributor to APH in the next 2-3 years before APH’s compostable material manufacturing plant comes into operation.

New projects related to packaging, supporting industries, industrial real estate, mold manufacturing is expected to contribute 50% to the overall growth of APH.